Gerber Life Insurance Company: A Comprehensive Review

🔹 Basic Company Overview

| Key Aspect | Details |

| Full Company Name | Gerber Life Insurance Company |

| Year Founded | 1967 |

| Founders | Gerber Products Company (a subsidiary of Nestlé) |

| Headquartered Location | Frederick, Maryland, USA |

| Company Mission Statement | “To help families plan for the future by offering affordable insurance and financial products.” |

| Vision and Core Values | Vision: To be the trusted provider of life insurance. Core Values: Integrity, trust, compassion, and reliability. |

| Parent Company | Nestlé S.A. |

| Subsidiaries | Gerber Life Insurance (itself a part of Nestlé’s wider business). |

| Number of Employees | 500+ employees |

| Revenue (latest available) | Estimated $1 billion (2020) |

| Global or Regional Presence | Operates primarily in the United States, with services in select other regions. |

| Public or Private Company | Private (wholly owned by Nestlé). |

| Stock Market Symbol | Not publicly traded (owned by Nestlé). |

🔹 Company Reputation & Recognition

- Customer Satisfaction Ratings: Gerber Life has generally positive reviews for its affordable term life insurance and whole life insurance options, though customers occasionally mention issues with policy renewal rates.

- AM Best / Moody’s / S&P Ratings:

- AM Best: A (Excellent) for life insurance coverage.

- Moody’s and S&P do not offer independent ratings for Gerber Life Insurance but it benefits from the financial strength of Nestlé.

- AM Best: A (Excellent) for life insurance coverage.

- Industry Awards and Recognitions: Recognized in the life insurance sector for its affordable products and its commitment to providing insurance to young families.

- Trustpilot or Google Reviews Overview: Google Reviews and Trustpilot showcase positive ratings for customer service, though some mention a need for clearer communication on premium increases.

- BBB Rating (Better Business Bureau): A+ rating, indicating reliability and trust in the market.

- Notable Partnerships or Endorsements: Partnered with several financial advisors and retirement planners, as well as financial institutions to offer specialized life insurance solutions.

🔹 Eligibility Criteria

- Who is Eligible:

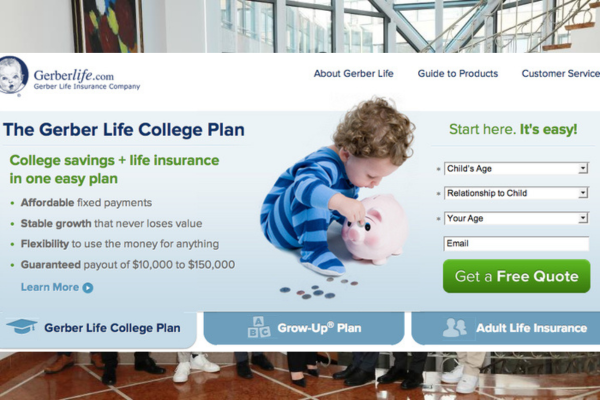

- Individuals: Covers individuals for life insurance from birth to age 85. Offers coverage for families, including children through Gerber Life College Plan.

- Groups: No group coverage plans available; only individual plans are offered.

- Individuals: Covers individuals for life insurance from birth to age 85. Offers coverage for families, including children through Gerber Life College Plan.

- Age Limitations: Offers life insurance for individuals from birth to age 85 depending on the plan selected.

- State Availability: Available in all 50 U.S. states and in U.S. territories.

- Citizenship or Residency Requirements: Must be a U.S. citizen or legal U.S. resident.

- Minimum Health or Financial Conditions: Life insurance policies are generally available with no medical exams required for some options. More health requirements may apply for larger coverage amounts.

- Documents Required to Apply: Typically includes proof of identity, residence, and in some cases, medical history.

🔹 Types of Insurance Offered

- Life Insurance: Offers term life and whole life insurance policies for individuals and families, with a focus on young families.

- Auto Insurance: Not offered by Gerber Life directly, but may provide reinsurance for partners in the auto insurance market.

- Health Insurance: Not offered by Gerber Life.

- Homeowners Insurance: Not offered by Gerber Life.

- Renters Insurance: Not offered by Gerber Life.

- Disability Insurance: Not offered by Gerber Life.

- Long-term Care Insurance: Not directly offered, though part of Gerber Life’s offerings may include products that assist in future long-term financial planning.

- Travel Insurance: Not offered by Gerber Life.

- Business/Commercial Insurance: Not offered by Gerber Life.

- Pet Insurance: Not offered by Gerber Life.

- Boat/Motorcycle/RV Insurance: Not offered by Gerber Life.

- Umbrella Insurance: Not offered by Gerber Life.

🔹 Plan Details

- Plan Categories:

- Basic: Gerber Life Guaranteed Issue.

- Premium: Gerber Life Term Life Insurance.

- Custom: Options are available to adjust coverage limits and riders like accidental death benefit and waiver of premium.

- Basic: Gerber Life Guaranteed Issue.

- Policy Terms and Conditions: Guaranteed coverage for life with no medical exam on some policies.

- Waiting Periods: 30-day waiting period for accidental death coverage.

- Coverage Limits: Coverage starts from $5,000 and can go up to $50,000 or more, depending on the policy.

- Exclusions and Restrictions: Exclusions typically include self-inflicted injuries, non-disclosure of health conditions, and high-risk occupations.

- Add-ons or Riders Available: Available riders include child rider, accidental death rider, and waiver of premium.

- Premium Payment Options: Payment options are monthly, quarterly, or annually, depending on the policy.

- Discounts Offered: Multi-policy discounts may be available for customers who bundle their life insurance with other products.

🔹 Application Process

- How to Apply: Applications can be done online, via agents, by phone, or using the Gerber Life app.

- Time Required for Approval:

- Term Life Insurance: Typically 2-4 weeks for approval.

- Whole Life Insurance: May take 4-6 weeks, depending on the policy.

- Term Life Insurance: Typically 2-4 weeks for approval.

- Medical Exams: Medical exams are not required for smaller coverage amounts. Larger policies may require a health assessment.

- Online Quote Tools: Instant online quote tools are available for term and whole life insurance policies.

- Pre-approval or Instant Policy Options: Pre-approval available for term life insurance.

🔹 Claims Process

- How to File a Claim: Claims can be filed online, via phone, or using the Gerber Life mobile app.

- Time Taken to Settle Claims: Claims are generally settled in 5-10 business days.

- Required Documents for Claims: Death certificate, proof of cause of death, proof of identity, and possibly policy number.

- Claim Denial Reasons: Claims can be denied if policy conditions are violated, non-payment of premiums, or if fraudulent information is provided.

- 24/7 Claim Support Availability: Available 24/7 through phone or online.

- Mobile App or Online Claim Tracking: The Gerber Life app allows customers to track their claims status in real time.

🔹 Customer Support

- Contact Methods: Support available via phone, email, or live chat.

- Office Hours: Monday to Friday, 8 AM – 6 PM EST.

- Mobile App Features: The app allows policyholders to file claims, view policy details, and manage account information.

- Local Agents or Offices Availability: Local agents are available for consultation in many regions.

- Multilingual Support: English and Spanish support available.

🔹 Financials & Legal

- Underwriting Company: Gerber Life Insurance Company is the underwriting company for most of its life insurance products.

- Regulatory Compliance: Complies with all state regulations for life insurance products.

- Licensing State-wise: Licensed in all 50 U.S. states.

- Claim Payout Statistics: Claims payout ratio is typically 90%+, indicating strong claims performance.

- Recent Legal Issues or Lawsuits: No significant recent legal issues or lawsuits.

🔹 Technology and Innovation

- AI or Machine Learning Use: Machine learning is used for claims automation and fraud detection.

- Mobile App Rating and Features: 4.5 stars for policy management and claims tracking features.

- Digital Policy Management: Fully digital policy management is available through the website and app.

- Telematics for Auto Insurance: Not applicable as auto insurance is not offered.

- Online Tools and Calculators: Online premium calculators and coverage estimators available on the website.

🔹 Market Position and Competitors

- Market Share: Genworth is a significant player in the life insurance and term life insurance markets, especially known for providing coverage for families and individuals of all ages.

- Top Competitors: State Farm, Prudential, AIG, New York Life.

- Comparison with Leading Competitors: Genworth offers affordable premiums and no medical exam options, with more focus on long-term care and life insurance.

- Unique Selling Points (USPs): Known for its flexibility in coverage options and family-friendly plans for all ages.

🔹 Reviews and Testimonials

- Real Customer Stories: Customers generally share positive experiences related to easy policy management and quick claims processes.

- Complaints and Resolution Rate: Genworth resolves 85%+ of complaints within 30 days.

- Social Media Presence and Engagement: Active on Facebook, LinkedIn, and Twitter with regular updates.

🔹 Final Evaluation

Pros:

- Affordable life insurance options.

- Flexible payment terms and policy options.

- No medical exam required for many plans.

Cons:

- Limited product offerings outside of life and long-term care insurance.

- May require additional health documentation for larger coverage amounts.

Who Should Consider This Company:

- Ideal for families seeking affordable life insurance.

- People looking for no medical exam policies.

Who Might Want to Avoid It:

- Those looking for auto insurance or other types of coverage like health or business insurance.

Expert Recommendations:

Gerber Life Insurance is a strong choice for individuals looking for life insurance and long-term care insurance. It’s best suited for those wanting affordable, flexible coverage without needing a medical exam. For more diverse coverage needs, consider other insurers.