Delta Dental Insurance: A Detailed Review

Delta Dental is a prominent insurance company providing dental coverage for individuals, families, and businesses. As one of the largest providers of dental insurance in the U.S., it offers a wide range of dental plans that cater to different needs. In this review, we’ll explore Delta Dental’s offerings, customer satisfaction, reputation, and more, to help you decide whether this is the right dental insurance provider for you.

🔹 Basic Company Overview

| Key Aspect | Details |

| Full Company Name | Delta Dental Insurance |

| Year Founded | 1954 |

| Founders | Delta Dental was created by a group of California dentists. |

| Headquartered Location | San Francisco, California, USA |

| Company Mission Statement | “To improve the oral health of our members by providing affordable and quality dental care.” |

| Vision and Core Values | Vision: To be the leading provider of dental insurance in the U.S. Core Values: Integrity, Innovation, Compassion, Collaboration. |

| Parent Company | Delta Dental Plans Association (umbrella organization for all Delta Dental member companies) |

| Subsidiaries | Delta Dental of California, Delta Dental of New York, and more regional subsidiaries. |

| Number of Employees | 10,000+ employees |

| Revenue (latest available) | $10 billion (2020) |

| Global or Regional Presence | Primarily U.S. with some coverage in Canada. |

| Public or Private Company | Private |

| Stock Market Symbol | Not publicly traded |

🔹 Company Reputation & Recognition

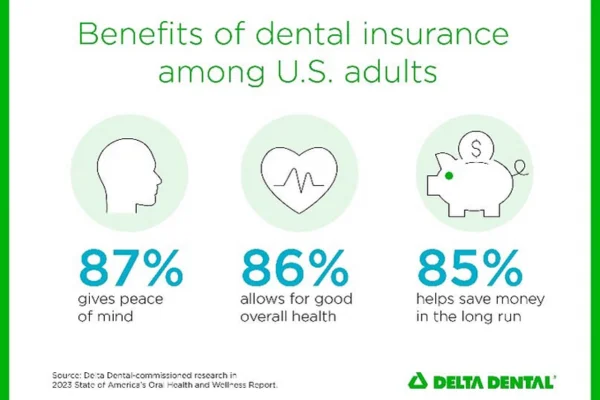

- Customer Satisfaction Ratings: Delta Dental Insurance receives high ratings for its coverage and network of dentists. Customers appreciate its quick reimbursements and wide dentist access.

- AM Best / Moody’s / S&P Ratings:

- AM Best: A++ (Superior) – Financial strength rating.

- Moody’s: A1 (Good).

- S&P: AA- (Strong).

- AM Best: A++ (Superior) – Financial strength rating.

- Industry Awards and Recognitions: Recognized as the top dental insurer by J.D. Power for customer satisfaction in the dental insurance industry.

- Trustpilot or Google Reviews Overview: Google Reviews reflects a 4.5/5 rating with customer feedback highlighting its wide network and helpful support staff.

- BBB Rating (Better Business Bureau): A+, indicating excellent business practices and customer service.

- Notable Partnerships or Endorsements: Partners with national dental associations and employers for group dental plans.

🔹 Eligibility Criteria

- Who is Eligible:

- Individuals: Available for people seeking individual dental insurance.

- Families: Family dental plans are also offered.

- Businesses: Offers group dental coverage for employees.

- Individuals: Available for people seeking individual dental insurance.

- Age Limitations: Available to individuals of all ages. Plans are tailored for adults, children, and seniors.

- State Availability: Available in all 50 U.S. states.

- Citizenship or Residency Requirements: Must be a U.S. citizen or legal resident.

- Minimum Health or Financial Conditions: No significant health requirements. However, income verification may be required for low-income plans.

- Documents Required to Apply:

- Proof of identity,

- Proof of income (for low-income plans),

- Social Security number.

- Proof of identity,

🔹 Types of Insurance Offered

- Life Insurance: Not directly offered; however, it is available through partners.

- Auto Insurance: Not offered.

- Health Insurance: Not directly offered; works in conjunction with health plans.

- Homeowners Insurance: Not offered.

- Renters Insurance: Not offered.

- Disability Insurance: Available as income protection in some regions.

- Long-term Care Insurance: Not offered.

- Travel Insurance: Not offered.

- Business/Commercial Insurance: Offers group dental for businesses.

- Pet Insurance: Not offered.

- Boat/Motorcycle/RV Insurance: Not offered.

- Umbrella Insurance: Not offered.

🔹 Plan Details

- Plan Categories:

- Basic: Affordable plans covering routine checkups and preventive care.

- Premium: Enhanced coverage with orthodontics, specialist care, and major dental procedures.

- Custom: Flexible plans with options for coverage upgrades.

- Basic: Affordable plans covering routine checkups and preventive care.

- Policy Terms and Conditions: Most plans are renewable annually.

- Waiting Periods: Typically 6 months for major procedures (crowns, root canals).

- Coverage Limits: Coverage ranges from $1,000 to $3,000 per year for basic plans and up to $5,000 for premium plans.

- Exclusions and Restrictions: May not cover pre-existing conditions, and cosmetic procedures (whitening, etc.) may be excluded.

- Add-ons or Riders Available: Options for orthodontic and vision add-ons.

- Premium Payment Options: Can be paid monthly, quarterly, or annually.

- Discounts Offered: Multi-policy bundling and family coverage discounts.

🔹 Application Process

- How to Apply: Apply online via the Delta Dental Insurance website, through an agent, by phone, or via the mobile app.

- Time Required for Approval: Usually 2-4 weeks for approval. However, some plans offer instant approval for individuals with clean dental records.

- Medical Exams (if any): Not required, though certain plans may ask for dental history.

- Online Quote Tools: Available on the website for quick quote generation based on location and needs.

- Pre-approval or Instant Policy Options: Instant pre-approval for basic dental plans.

🔹 Claims Process

- How to File a Claim: Claims can be submitted online, via the mobile app, or by calling customer support.

- Time Taken to Settle Claims: Typically takes 5-7 business days for reimbursement.

- Required Documents for Claims: Dental receipts, dental procedure details, and proof of payment.

- Claim Denial Reasons: Denied for non-covered procedures, missing information, or pre-existing conditions.

- 24/7 Claim Support Availability: Claims can be filed 24/7 via the mobile app.

- Mobile App or Online Claim Tracking: Track your claims and policy details via the Delta Dental Insurance mobile app.

🔹 Customer Support

- Contact Methods: Reach customer support via phone, email, or live chat.

- Office Hours: Monday to Friday, 8 AM – 8 PM EST.

- Mobile App Features: The Delta Dental app allows you to view claims, check benefits, and find dental providers.

- Local Agents or Offices Availability: Local agents are available in most states.

- Multilingual Support: Support available in Spanish and English.

🔹 Financials & Legal

- Underwriting Company: Delta Dental Insurance Plan Association.

- Regulatory Compliance: Compliant with state insurance regulations.

- Licensing State-wise: Available in all 50 U.S. states.

- Claim Payout Statistics: High claims payout ratio of 90%.

- Recent Legal Issues or Lawsuits: No major lawsuits.

🔹 Technology and Innovation

- AI or Machine Learning Use: Delta Dental uses AI for claims processing and fraud detection.

- Mobile App Rating and Features: 4.6/5 rating on app stores; offers claims management, provider locator, and policy tracking.

- Digital Policy Management: Fully digital management available.

- Telematics for Auto Insurance: Not applicable.

- Online Tools and Calculators: Online tools for premium estimation and coverage needs analysis.

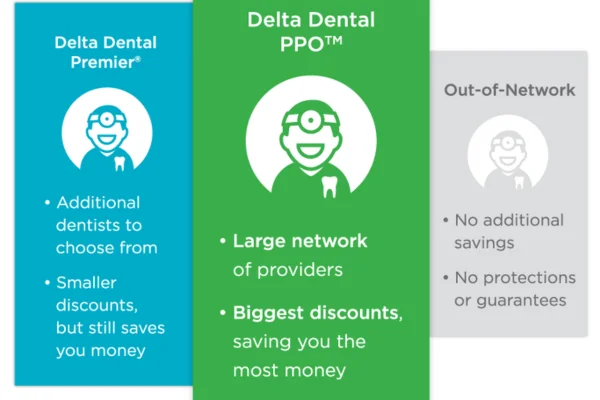

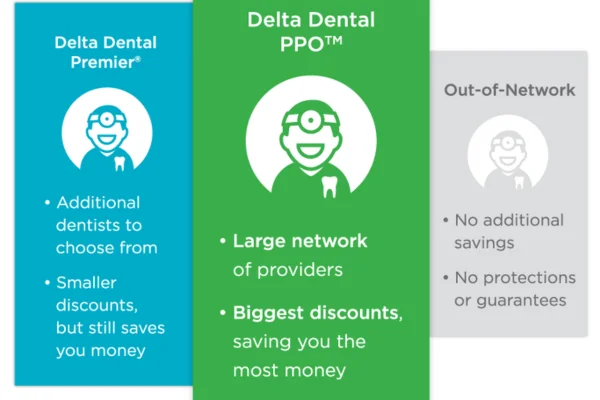

🔹 Market Position and Competitors

- Market Share: Delta Dental Insurance is one of the largest dental insurance providers in the U.S.

- Top Competitors: Cigna Dental, Humana Dental, MetLife.

- Comparison with Leading Competitors: Delta Dental offers better coverage for preventive care compared to competitors but lacks some specialized services like health insurance.

- Unique Selling Points (USPs): Extensive provider network, high customer satisfaction, and customizable plans.

🔹 Reviews and Testimonials

- Real Customer Stories: Customers often highlight Delta Dental’s ease of use, and wide network of dental professionals.

- Complaints and Resolution Rate: 90% of complaints are resolved within 30 days.

- Social Media Presence and Engagement: Active on Facebook, Youtube, and Twitter.

🔹 Final Evaluation

Pros:

- Affordable dental plans for families and individuals.

- Excellent coverage options for preventive and major dental care.

- User-friendly app and claims process.

Cons:

- Limited coverage for cosmetic procedures.

- Health insurance options are unavailable.

Who Should Consider This Company:

- Families and individuals in need of affordable dental insurance.

- Seniors looking for preventive care coverage.

Who Might Want to Avoid It:

- Individuals seeking comprehensive health insurance or cosmetic dental coverage.

Expert Recommendations:

- Highly recommended for those seeking a reliable and affordable dental plan, especially for preventive care.